Productivity growth is the key mechanism that allows the U.S. economy to expand above its long‑run trend without reigniting inflation. Recent data show U.S. nonfarm business productivity rising 4.9% in Q3 2025, a surge strong enough to counter inflationary pressures even amid solid economic growth. Beyond containing inflation, faster productivity growth also helps offset structural headwinds from slowing population growth, a shrinking labor force, and an expanding retiree cohort. Technological innovation is poised to provide the backbone for this productivity boost. The U.S. remains among the world’s productivity leaders — it ranks near the top of major advanced economies, placing it ahead of Germany, France, the U.K., Japan, and Canada.

When Output Surged and Hours Didn’t

U.S. productivity growth surged to 4.9% in Q3 2025, largely because output grew far faster than hours worked. According to the Bureau of Labor Statistics, real value‑added output increased 5.4%, while hours worked rose only 0.5%, meaning companies produced significantly more without a comparable increase in labor input. This dynamic — strong output gains paired with minimal hiring — reflects firms’ continued adoption of more efficient processes, including automation, data‑driven decision tools, and other technologies that raise output per hour. Later in this piece, we show that many industries have further to go to increase artificial intelligence (AI) adoption rates.

The productivity pop also suggests that businesses facing higher labor costs in prior quarters have intensified efforts to improve efficiency, leading to lower unit labor costs (–1.9%) in Q3. Together, these factors explain why productivity jumped so sharply: firms were able to meet demand while relying on smarter production methods rather than expanding payrolls. In part, we expect growth in 2026 will remain above trend, expected to reach 2.5% year over year based on data currently on hand, with most of the growth front-loaded in the first two quarters.

The Low-Hire, Low-Fire Job Market

A big risk to growth in 2026 are the warning signs from the job market. Despite a consensus view that we have a labor supply problem, our view is that we instead have a labor demand problem. Job growth is weakening (demand side) and unemployment remains low (supply side). If labor supply was short, firms would have many more job openings, and push compensation higher, but that is currently not the case. Perhaps it’s a combination of both, but either way, job growth is expected to deteriorate further. Average monthly gains in 2026 will likely hover around 40,000 per month. With our forecasts for lower labor demand and an increase in unemployment this year, we expect productivity gains will offset these fundamental weaknesses.

So, Where Are the Opportunities?

As we search for opportunities, we first need to understand the underlying dynamics of the current economy, and here is something worth highlighting. Robust revenue growth across major healthcare facilities reflects exceptionally strong demand for medical services, and this strength has made the healthcare sector a notable contributor to recent economic growth. Large U.S. health systems have reported broad increases in patient volumes and service utilization, underscoring the depth of demand across hospitals and clinics. These rising revenues translate directly into gross domestic product (GDP) because the Bureau of Economic Analysis (BEA) relies heavily on company‑reported revenue and receipts as source data for estimating industry value added. In the case of healthcare, the BEA incorporates revenue streams from hospitals, physician groups, outpatient centers, and other providers to calculate the sector’s gross output, which then feeds into GDP by industry. The BEA’s use of these revenue‑based data ensures that when healthcare facilities experience strong financial growth, it appears as a measurable contribution to overall economic expansion — illustrated by the healthcare services sector contributing 0.75 percentage points to real GDP growth in Q3 2025.

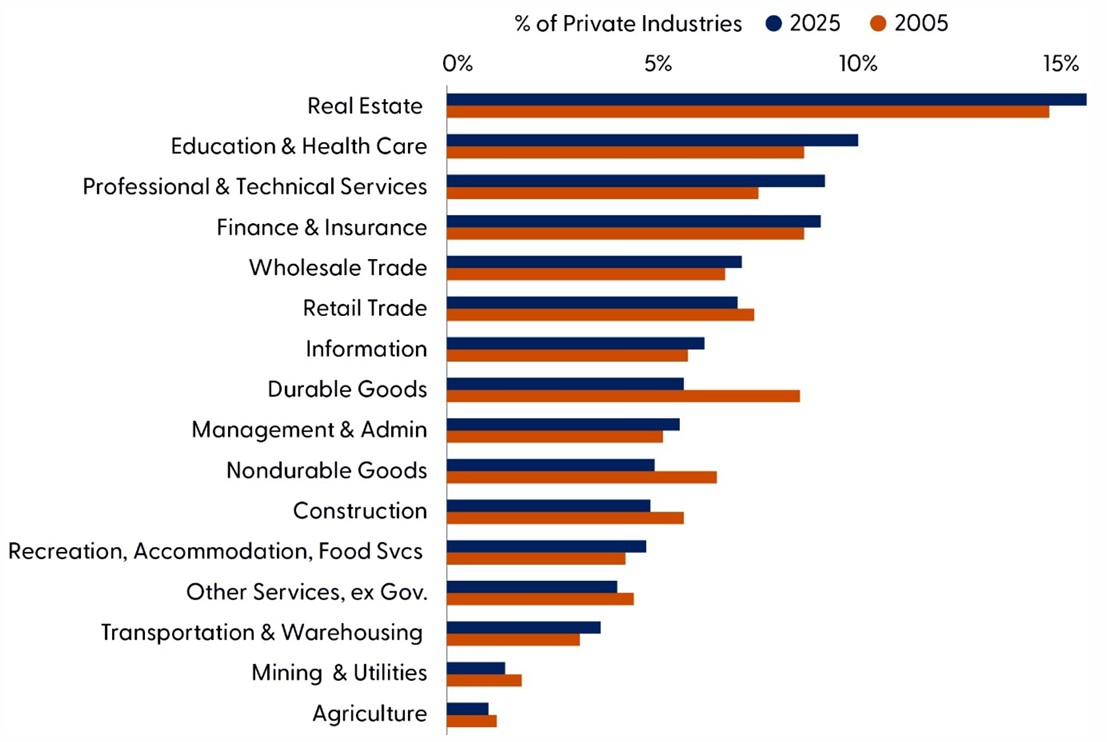

Demand for Health Care Services Will Impact Composition of the Economy

Source: LPL Research, Bureau of Economic Analysis, 01/26/26

Over the past economic cycle, the composition of the U.S. economy has continued its long‑running shift toward services, with the FIRE industries — finance, insurance, and real estate — forming the largest share of value added. FIRE accounts for more than one‑fifth of U.S. GDP, making it the single largest broad sector in the economy, a trend reinforced by consumers’ increasing preference for services over goods. As the population ages, demand for healthcare services has also grown sharply, pushing healthcare and social assistance into a more prominent role in economic growth. These demographic shifts cement services — particularly FIRE and healthcare — as central pillars of economic activity, shaping both labor demand and investment patterns.

At the same time, the production side of the economy has undergone its own structural change. The U.S. has experienced a multi‑decade decline in manufacturing employment, falling from 26% of private employment in 1980 to just 9% in December 2025, reflecting a broad transition away from goods‑producing sectors. Although goods output (durable and nondurable) has trended upward in absolute terms over the long run, industrial production has been largely flat since the mid‑2000s, even as goods’ GDP has risen, signaling efficiency gains rather than renewed production intensity. Despite the current shift toward more restrictive trade policies, these longer‑term structural forces make a broad reversion back to a goods‑heavy economic composition unlikely.

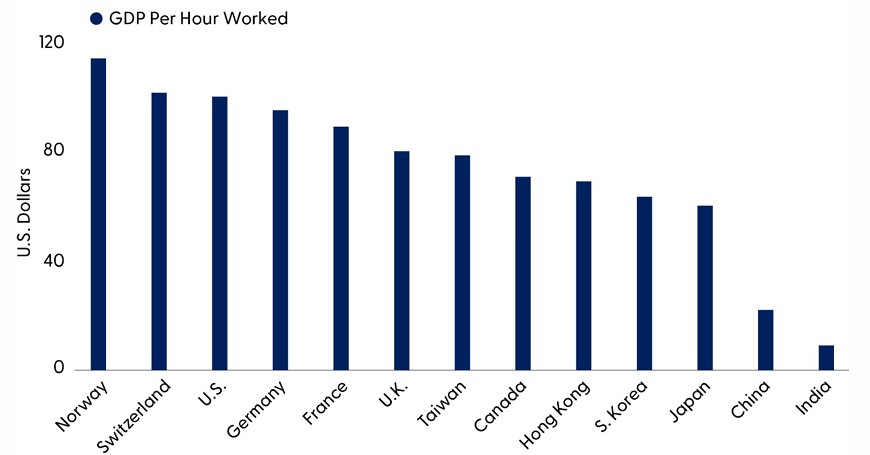

Global Productivity Rankings: The U.S. Near the Top

Stronger U.S. productivity growth can help sustain the economic exceptionalism seen in recent years by reinforcing the nation’s ability to grow even in the face of mounting global and domestic headwinds. When output per worker rises, the economy can expand without stoking inflation, giving policymakers more flexibility and investors more confidence. That matters now more than ever: shaky geopolitics, rising public debt, and an uncertain monetary policy path have all added ambiguity to the outlook. A robust productivity trend can counter those pressures by boosting corporate profitability, supporting real wage gains, and anchoring the U.S. as a globally competitive and innovative economy. In a landscape full of macro risks, the U.S. productivity story offers something rare — an underlying force strong enough to calm nerves and help extend the country’s run of outperformance.

U.S. Exceptionalism Shows Up in High Productivity

Source: LPL Research, Conference Board, 01/26/26

U.S. productivity outperforms other regions, such as in Europe, for a mix of structural, technological, and institutional reasons. One factor is the U.S. economy’s larger capital investment in advanced technologies, including software, computing, and AI. The U.S. devoted larger percentages of GDP to tech investment compared with the Eurozone, a difference that compounds over time as tech‑intensive firms scale faster. Larger capital investments in research and development (R&D) fuel innovation and diffusion of new production methods. European productivity growth has also been held back by deeper structural issues, such as weaker balance sheets and tighter credit constraints following the global financial crisis, which has slowed the reallocation of capital toward more productive businesses.

A second key driver is the U.S. economy’s ability to foster business creation and destruction, which accelerates the shift of resources toward high‑productivity firms. Europe’s more rigid business environment — characterized by slower competitive turnover, heavier administrative burdens, and fragmented regulations across member states — reduces the speed at which innovation permeates the economy. Relatively fast tech adoption, high R&D and intangible investment, and business dynamism explain why U.S. productivity outpaces other major economies.

It’s worth noting that Norway tends to top the list in productivity growth because of its unique composition. The oil and gas sector is the largest contributor to Norway’s economy, with significant oil and gas exports. Norway benefits from a high‑value, capital‑intensive industrial structure, particularly its offshore energy sector, which generates large amounts of value added with relatively few hours worked. This boosts national output per hour even though it does not reflect typical service‑sector productivity, making Norway an outlier.

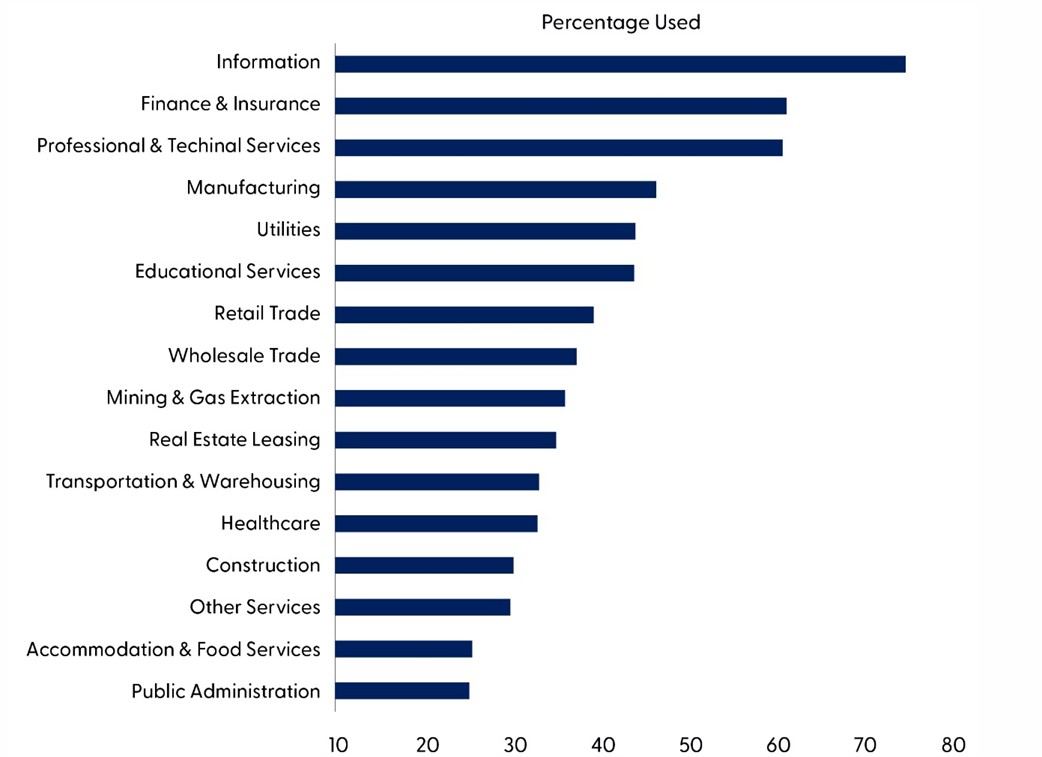

Early Innings of AI Usage

We are still in the early innings of AI adoption, especially in labor‑intensive service industries where workflows remain heavily manual and fragmented. Surveys show that while over 92% of companies plan to increase AI investment, only 1% consider themselves mature users, meaning most organizations have barely begun integrating AI into day‑to‑day operations. Likewise, generative‑AI adoption among U.S. workers still represents a small share of actual work hours, with only 5.7% of job time involving generative AI as of mid‑2025. These findings underscore how much runway remains for industries like healthcare, administration, logistics, and customer service, where routine documentation, scheduling, compliance, and data processing tasks are ripe for automation. As AI tools become more embedded in frontline workflows, the opportunity for step‑level improvements in utilization rates and process efficiency expands dramatically.

This early-stage adoption dynamic suggests that some of the largest productivity gains are still ahead, particularly in service sectors that have historically lagged in digital transformation. We anticipate meaningful AI‑driven productivity improvements in healthcare and administrative services, where AI can streamline case management, automate paperwork, assist with diagnostics, and reduce time spent on routine tasks — areas ripe for efficiency gains precisely because they remain so labor‑intensive. Research from manufacturing already shows an “AI J‑curve,” in which initial adoption slows productivity before delivering stronger long‑run gains — a pattern likely to repeat across services. As AI scales, service providers will be able to handle higher volumes with fewer bottlenecks, enabling faster throughput, better resource allocation, and ultimately, higher productivity growth across the economy.

Hotels, Restaurants, Health Services Among Sectors to Benefit from Higher AI Utilization

Source: LPL Research, RAMP Economics Lab, 01/26/26

Conclusion

In sum, the U.S. economy enters 2026 with a unique blend of strengths and opportunities that help offset its cyclical vulnerabilities. We expect real economic growth to reach 2.5% year over year, according to the latest data. Nominal growth — which is a good predictor of corporate earnings growth — is expected to surpass 5%. The recent surge in productivity — driven by strong output gains, lean hiring, and early adoption of more efficient technologies — provides a powerful foundation for above‑trend growth, even as labor demand softens.

At the same time, structural shifts toward services, especially in FIRE industries and healthcare, continue to reshape the composition of economic activity, reflecting both demographic trends and the rising value of knowledge‑ and care‑based work. These sectors, along with others still in the early stages of AI integration, hold substantial potential for further efficiency gains as automation and data‑driven tools diffuse more widely. Combined with the United States’ longstanding advantages in innovation, investment, and business dynamism, these forces suggest that productivity will remain a critical stabilizer — supporting U.S. exceptionalism, balancing near‑term risks, and positioning the economy to extend its outperformance in the years ahead.

Asset Allocation Insights

LPL’s Strategic Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities. Investors may be well served by bracing for occasional bouts of volatility given how much optimism is reflected in stock valuations, but fundamentals remain broadly supportive. Technically, the broad market’s long-term uptrend remains intact, leaving the Committee biased to buy potential dips that emerge.

STAAC’s regional preferences across the U.S., developed international, and emerging markets (EM) are aligned with benchmarks, though an improving technical analysis picture in EM is noteworthy. The Committee still favors the growth style over its value counterpart, large caps over small caps, the communication services sector, and is closely monitoring the healthcare, industrials, and technology sectors for opportunities to potentially add exposure.

Within fixed income, the STAAC holds a neutral weight in core bonds, with a slight preference for mortgage-backed securities (MBS) over investment-grade corporates. The Committee believes the risk-reward for core bond sectors (U.S. Treasury, agency MBS, investment-grade corporates) is more attractive than plus sectors. The Committee does not believe adding duration (interest rate sensitivity) at current levels is attractive and remains neutral relative to benchmarks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings in commodities will result in significant volatility in an investor’s holdings. Commodities include increased risks, such as political, economic, and currency instability, and may not be suitable for all investors.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0006529-1225 Tracking #853068 | #853069 (Exp. 1/27)